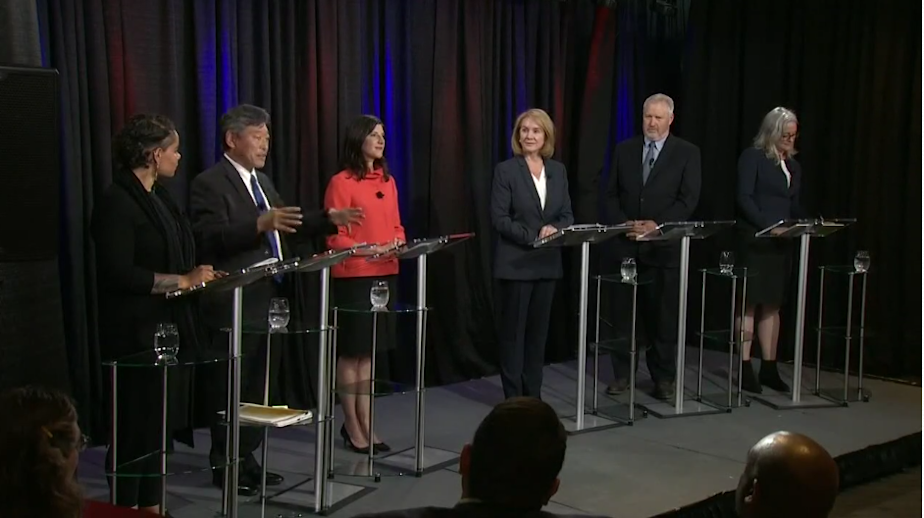

Highlights from Seattle mayoral debate

Are Seattle taxes too high? And where should the city look for future funding? Those were the big questions for six of the city’s candidates for mayor Monday, at a debate aired live on KUOW and KING 5.

There were significant differences on where candidates would spend and where they would seek cuts.

The candidates were informed that, according to the Seattle Times, city spending has increased by more than $2,000 per resident over the past four years.

And they had one response in common: no one is seeking to increase sales or property taxes for any purpose.

“I’ve been calling for a freeze on regressive taxes all along,” said state Sen. Bob Hasegawa. “That’s one of the main drivers for the displacement and gentrification that’s happening in our city. People just can’t afford to keep up if you’re on fixed income or lower and middle income.”

Former state legislator and transit advocate Jessyn Farrell said if Seattle’s income tax proposal overcomes a legal challenge and takes effect, that money should be used to cut existing taxes.

“We need to be buying down property tax and sales tax, and if there’s money left over we need to focus on affordability,” she said. “There is an affordability crisis in this city and we need to make sure people aren’t left behind.”

Farrell said developers and corporations should also pay more to help with the consequences of Seattle’s growth.

Urban planner Cary Moon said under an income tax, she’d also seek to cut current taxes, but she’d use remaining money differently.

“I would look first at how we can reduce the regressive sales and property taxes; people are overburdened with taxes at this time," Moon said. "So we need to look at how do we reduce that, and then we need to look at how we invest in education.”

Moon also supports a real estate tax on properties purchased as investments by non-resident and corporate buyers, similar to a tax enacted in Vancouver, B.C.

Former U.S. attorney Jenny Durkan has been skeptical about an income tax surviving a court challenge, but if it happens, she’d also seek to reduce existing taxes.

“I have doubts as to whether it will be upheld,” she said. “But I think that having an income tax statewide would be critical. If we have it locally we need to extend it regionally. Because I think right now our tax system is unfair, people who have less are paying more and that’s not right.”

Durkan would also seek to cut the city’s business and occupation taxes.

“Our small businesses are struggling and I believe they’re one of the backbones for the fabric of our city, so if we have money we need to make sure we lessen the burden on them,” she said.

The other candidates talked more about raising, rather than cutting, business taxes. Former Mayor Mike McGinn said if elected he’ll cut city spending that has increased under Ed Murray, who replaced him as mayor.

“The mayor’s office budget alone has increased 80 percent in the last three years," McGinn said. "I’m going to hold the line on property taxes and sales taxes and regressive taxes. To the extent we need new funds we have taxing mechanisms at our disposal to tax the big corporations that are enjoying such success in our city.”

Lawyer and case manager Nikkita Oliver said she would seek a corporate head tax, as well as impact fees, to pay for growth, which are popular with several candidates.

“As our city continues to grow, it’s also incredibly important to understand that infrastructure is going to require investment. And we need to ask developers to invest more in that,” she said. “That requires asking for impact fees.”

Oliver said affordable housing and the homelessness crisis would be her top priorities if elected. To that end, Oliver said if Seattle’s income tax does take effect, she would not try to bring down existing taxes, but put all the proceeds towards affordable housing.

“If we’re really going to dig our way out of a state of emergency we have to commit a substantial amount of public dollars to public housing that is affordable,” she said.

Watch the full debate: