Big insurers rack up billions in surpluses, now lawmakers may take a bite of the pie

In recent years, people who buy health insurance on the individual market have experienced steep premium hikes, higher deductibles and increases in other out-of-pocket expenses. At the same time, Washington’s three biggest nonprofit insurers have amassed nearly $4.5 billion dollars in surpluses.

Now, two proposals in the Washington Legislature are taking aim at those surpluses.

One bill would allow the state’s Office of the Insurance Commissioner (OIC) to take into account surpluses when setting rates – something other states allow, including Oregon, but not Washington. It’s an idea that’s been batted around Olympia for at least 15 years, but appears to have fresh momentum this year.

“If allowing the insurance commissioner to see what these surpluses are helps us to reduce premium increases just a little bit, it will help a lot of Washingtonians,” said Sen. Christine Rolfes, the Democratic sponsor of the measure, at a recent public hearing for her legislation.

Rolfes called it a “fairly straightforward” bill. But the nonprofit insurance companies – Regence BlueShield, Premera Blue Cross and Kaiser Foundation Health Plan of Washington -- oppose it.

“We’re a group of insurers here who are in the most volatile markets in Washington,” testified Carrie Tellefson, a lobbyist for Regence BlueShield. “We’re in the individual market, we’re in the small group market, we’re playing in the areas that nobody else wants to play because they’re not very profitable.”

Sponsored

Another proposal in Olympia would go even further. The bill would require nonprofit health insurers to pay three percent of their excess reserves to fund premium subsidies and foundational public health services. This is a new idea that’s been introduced this year by Democrats in both the Washington House and Senate.

“We’re not taking all of their capital, we’re taking a small percentage as a tax to shore up our public health system,” said state Democratic Rep. June Robinson, the sponsor of the House version of the bill.

But Robinson’s bill, and its companion in the state Senate, have generated forceful opposition from the industry.

“We view it as an entirely new, untested and un-vetted proposal whose impact will be devastating on the not-for-profit business model,” testified Gary Strannigan with Premera Blue Cross.

Since the Affordable Care Act was signed into law, the combined reserves of Washington’s three largest nonprofit health insurers have shot up from nearly $2.4 billion in 2010 to $4.45 billion last year.

Sponsored

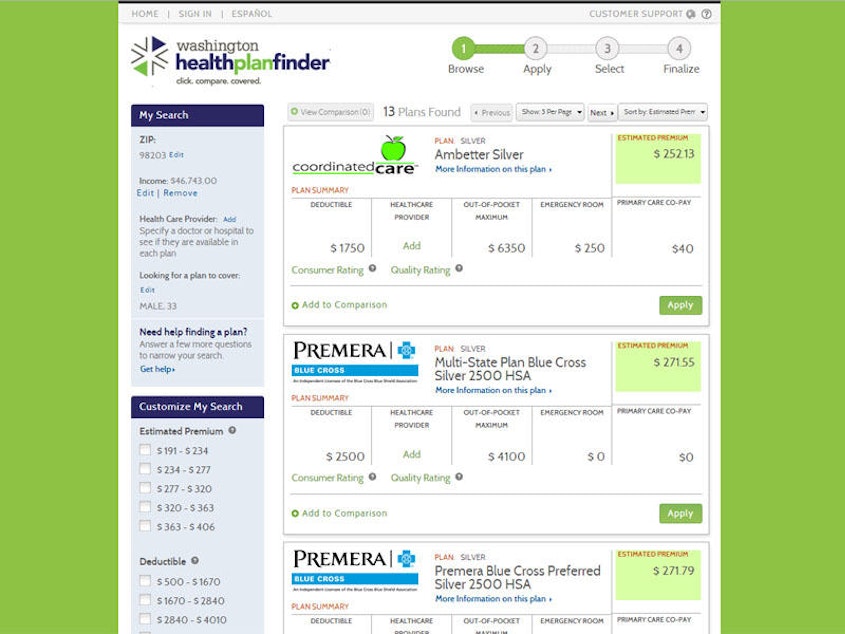

At the same time, consumers have been socked by steadily rising health insurance premiums. In 2017, 2018 and 2019, the insurance commissioner approved double-digit increases in the individual health insurance market.

For instance, Premera raised rates 19 percent in 2017 and 35 percent in 2018. During that same time, the company’s surplus grew by $700 million, according to figures provided by the insurance commissioner’s office.

“That just screams like, maybe it’s time to take a look at this,” said Amy Brackenbury, a lobbyist for the Public Health Roundtable, at one of the public hearings.

Washington’s insurance commissioner requires health insurers to maintain robust surpluses – what is known as Risk Based Capital (RBC) – to protect against insolvency. But some lawmakers and advocates say the surpluses have now climbed far above what’s needed to have a healthy surplus and should be returned back to ratepayers or the community at large.

The minimum RBC is 300 percent of a company’s total adjusted capital. OIC figures show that, as of 2018, Regence’s RBC ratio was at 1,550 percent, Premera’s was 1,334 percent and Kaiser’s 600 percent.

Sponsored

The companies and their trade group, the Association of Washington Healthcare Plans, respond that the large surpluses are mostly the result of stock market gains – and not higher insurance premiums – and are needed to in the event of a catastrophic event and to fund future investments. They also maintain that nonprofit insurers don’t have the same access to capital as for-profit companies.

Washington Insurance Commissioner Mike Kreidler has not endorsed the proposed tax on surpluses. But his office is backing the bill to give the OIC authority to consider surpluses when determining if a request to increase premiums is reasonable.