Beware the swindler disguised as philanthropist MacKenzie Scott

Two years ago, MacKenzie Scott signed the Giving Pledge. She agreed to give away half of her $35 billion fortune. That announcement came about two months after her divorce from Jeff Bezos, the world's richest person.

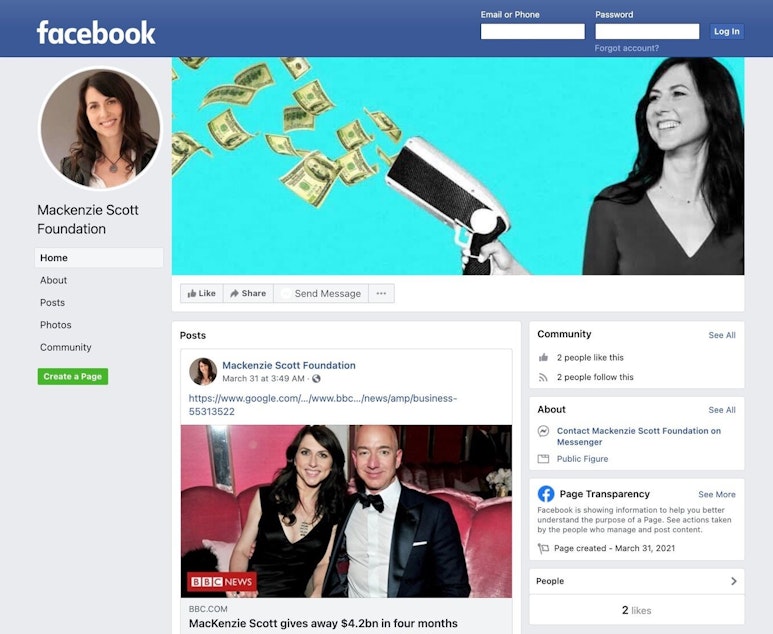

Now, scammers are taking advantage of MacKenzie Scott's generosity by posing as Scott, or a fake foundation that bears her name.

Nicholas Kulish has been reporting on these scam rings for the New York Times. He spoke to KUOW’s Kim Malcolm about the schemes.

This interview has been edited for clarity.

Nicholas Kulish: Last year, it's safe to say MacKenzie Scott became the most important philanthropist in America, in a way. She gave away nearly $6 billion, which in and of itself is just a huge amount of money, but it was also incredible how she did it.

She didn't set up a large, complex foundation, like the Bill and Melinda Gates Foundation, or Bloomberg Philanthropies. Instead, she worked with advisors and gave money quickly in large sums to organizations that could spend it. That would include groups like community colleges, historically Black colleges and universities, food banks, groups that help with medical debt, all kinds of organizations that could help people right away.

Kim Malcolm: There wasn't a whole lot of advanced notification about this giving.

Kulish: Right. I've spoken to some of these organizations. They would just receive an email or a phone call saying, "We have a donor who wants to give you a large amount of money." Many of these groups thought it was a scam, but it turned out to be true.

Malcolm: Then it turned out there were times when it wasn't true. You write about a woman named Danielle Churchill.

Kulish: Unusually for me as a reporter, I did not find her. She found me while she was still in the middle of the scam. She started sharing the screenshots from these messages that she was receiving, purportedly from MacKenzie Scott. I began doing the reporting and figuring out that there was no way that this was MacKenzie Scott.

Malcolm: And how much money did Danielle lose?

Kulish: She ultimately lost around 10,000 Australian dollars. That's a lot of money to anyone, but Danielle is a mother of five raising her kids alone, including one with special needs.

Sponsored

Malcolm: It sounds like these scammers were going to great lengths. Can you describe exactly how they pulled people in?

Kulish: One thing that is always really important to remember is that the scammers are paying attention to what's going on. If there's a hurricane, it's hurricane relief, or it's FEMA. If there's a pandemic, it's PPP loans. The experts that I spoke with said that all the publicity around MacKenzie Scott's giving, combined with the fact that there was no phone number or email address or any way that someone could check the veracity of this claim, made it particularly advantageous for these scammers.

We saw fake Instagram pages, fake Facebook pages. Then they actually went so far as to set up a fake bank with a whole website, username, password, terms and conditions, everything totally legitimate-looking, in order to trick Danielle into thinking that she had received the money from this MacKenzie Scott foundation that doesn't exist.

Malcolm: How did they actually get the money from her? What were they asking for?

Kulish: I've never been involved in one of these. I picture people getting a letter, and then immediately sending money. What actually happens is much more devious. They're dealing with her for a long time, and they're never asking her for money. They're just telling her that she's getting the money. Then once she can see the money in this fake bank account, then they say, “Oh, because you're in Australia, you need a Tax ID number. It’s going to cost a couple of hundred dollars.”

Sponsored

At that point, you can already see the money has been transferred into the account, and you're just being asked for this small fee. So, it's kind of logical. Aren't we all used to paying fees that we don't expect to accomplish anything in our lives?

Then, what the psychologists say is they start pulling you into a sunk costs situation. The more money you put in, the more now you want to believe that it's eventually going to pay off, or you've lost this money for nothing.

Malcolm: Why would MacKenzie Scott's name and image have become a favorite for scammers to get behind?

Kulish: First of all, it's important to note that the scammers have imitated the Small Business Administration. They’ve imitated the Federal Trade Commission, which actually is supposed to crack down on these scams. They've imitated Warren Buffett and Bill Gates, too. This is not just a MacKenzie Scott thing.

Consider both the publicity she received last year for giving away the $6 billion, but also very specifically the way that it was done. An email out of the blue promising money sounds too good to be true, but the New York Times and many other publications had said this is exactly what she's doing. I think that made it more plausible than the usual email promising money would seem.

Sponsored

Malcolm: What has happened to Danielle Churchill, the mother in Australia who was out $10,000?

Kulish: A lot of people who read the article went online and donated money to the GoFundMe page set up to help her son. After many months of suffering, she actually can afford some of those therapies that she hoped for her son to begin with.

Listen to the interview by clicking the play button above.