Townhomes are making Seattle more affordable, new study finds

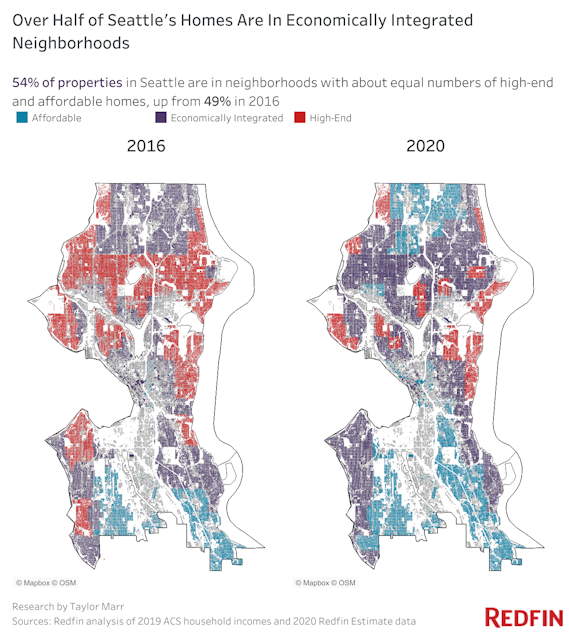

A new Redfin report shows Seattle has become the most economically integrated city in the nation. That means that in Seattle, more than anywhere else, bosses live near their lower-wage employees.

The report's findings may seem counterintuitive, given the accounts of high prices and bidding wars that seem to tell a different story.

People love to hate townhomes. On many community message boards, one can find complaints about how denser housing has changed the character of a neighborhood.

But there's an important and often overlooked way that townhomes have changed the character of many Seattle neighborhoods, said Taylor Marr, the chief economist for Redfin.

Townhomes and condos are helping make Seattle more affordable. Not affordable to everyone, but affordable to households making just over $100,000 a year. In Seattle, that's considered an average income.

H

omes are growing more expensive because land is limited in this region. Other cities, like Houston for example, have more room to spread out — to sprawl. But in this region, with mountains to the east, water to the west, and a desire not to pave over every farm and forest to the north and south, a limited supply of land to house more and more people has driven up the cost of land here.

Sponsored

Denser housing makes better use of limited land, Marr said.

"The condos, the townhomes, the multifamily properties can divide up the cost of this really valuable land across three or four units at once."

Here's where many people might say, "Yeah, but those townhomes are expensive."

First, a new townhome isn't so comparable to an older home that has all kinds of deferred maintenance. Comparing buildings of similar quality in the same neighborhood, townhomes are typically cheaper, though there are exceptions.

And second, collectively sky-high home prices are only one contributing factor to an individual home's cost. Another big consideration is the interest rate people pay on a mortgage. Interest rates have been at rock bottom for a long time now.

That means that while home prices have risen, the amount people pay for a monthly mortgage hasn’t risen much in four years. In that time, Marr said the average monthly mortgage payment in Seattle has risen just 1.8%.

Sponsored

"Even though we've seen home prices skyrocket — we've seen home prices grow more than 22%, including all properties on and off the market," Marr said. "But I think what most people fail to realize is how much mortgage rates have come down to completely offset that."

M

arr said in 2016, neighborhoods like Ballard were affordable only to a few. But as townhomes have replaced single family homes, these once exclusive neighborhoods have now flipped, and are now considered economically integrated.

Other neighborhoods, once considered exclusive, have also become integrated. Those include West Seattle, Mt. Baker, Judkins Park, and even Greenlake and the eastern side of Magnolia.

Sponsored

The neighborhoods that remained exclusive, such as Laurelhurst and the eastern part of Wallingford, have seen fewer new townhomes than other parts of the city.

The new, more affordable homes being built in Seattle do have one serious drawback, though: They're small — usually with one or two bedrooms. While acceptable for young people, larger families might find them unsuitable.

To find an affordable three or four-bedroom home to raise a larger family, people must look in the suburbs, he said.

Affordable homes are also in short supply. Marr's research looked at all homes — not just what's available on the market at a given time.

People in affordable homes tend to stay in them, rather than sell them, he said. And once affordable homes come on the market, they tend to stay there only a short period of time. The more expensive homes that remain can warp our sense of the price of homes, Marr said.

Sponsored

For people making far less than the average household income of just over $100,000 year, they'll likely have to look to the suburbs, too.